The Employment Fund collects unemployment insurance contributions used for funding earnings-related unemployment benefits and promoting employees' competence development through adult education benefits. The Employment Fund is an important part of the Finnish social security system, and all employers and 18-64-year-old employees in Finland are its customers.

The Employment Fund has a staff of some 150. The Fund provides advice to its customers in matters concerning unemployment insurance contributions and adult education, and contributes to changes to legislation in its sector.

The Employment Fund is an organisation established by law and managed by the labour market parties. The Employment Fund was launched on 1 January 2019 through the merger of TVR and the Education Fund. The Finnish Financial Supervisory Authority is the Employment Fund's regulator.

Unemployment insurance contributions are collected from both employers and employees on the basis of the actualised wage bill. Contributions are paid to the Employment Fund by the employer, which withholds the employee's share from the employee's pay.

The Employment Fund pays to the unemployment funds what is needed for the earnings-related part of earnings-related allowance with the exception of the share collected through unemployment fund membership fees. The fund also pays the central government transfer to the unemployment funds. The central government transfer is funded by taxes. An amount is paid annually to Kela from the unemployment insurance contributions that corresponds to the share by employees who are not members of any unemployment fund.

Unemployment insurance contributions are not only used to fund unemployment insurance but also employment pension accumulating during earnings-related allowance periods. These funds are paid to the Finnish Centre for Pensions and the State Pension Fund of Finland.

The Employment Fund pays adult education benefits and scholarships for qualified employees to support work competences. Benefits are paid for professional training and development. Employees' adult education benefits are funded in full by unemployment insurance contributions. The state pays for entrepreneurs' adult education benefits and government officials' scholarships for qualified employees.

Employees may be eligible for pay guarantee paid by the Ministry of Economic Affairs and Employment if they have pay receivables owing to the employer's insolvency. This benefit, too, is funded with unemployment insurance contributions.

Part of the unemployment insurance contributions are transferred to a business cycle buffer, the purpose of which is to guarantee that the level of unemployment insurance contributions remains stable. The objective is to build up a buffer that can be tapped into in times of higher unemployment to keep contribution increases lower. Known also as an EMU buffer, this buffer has been used during the past 20 years several times to moderate contribution increases.

The unemployment insurance system directs the employees' and employers’ unemployment insurance contributions in full to finance unemployment allowances, adult education benefits, and pay and pension security. In addition, they are used to finance training compensation and liability components. You can select English subtitles on the video.

The YouTube video is not available if you have chosen only necessary cookies on our pages. If you want to see the video go to data protection page, klick on change your consent and choose allow all cookies.

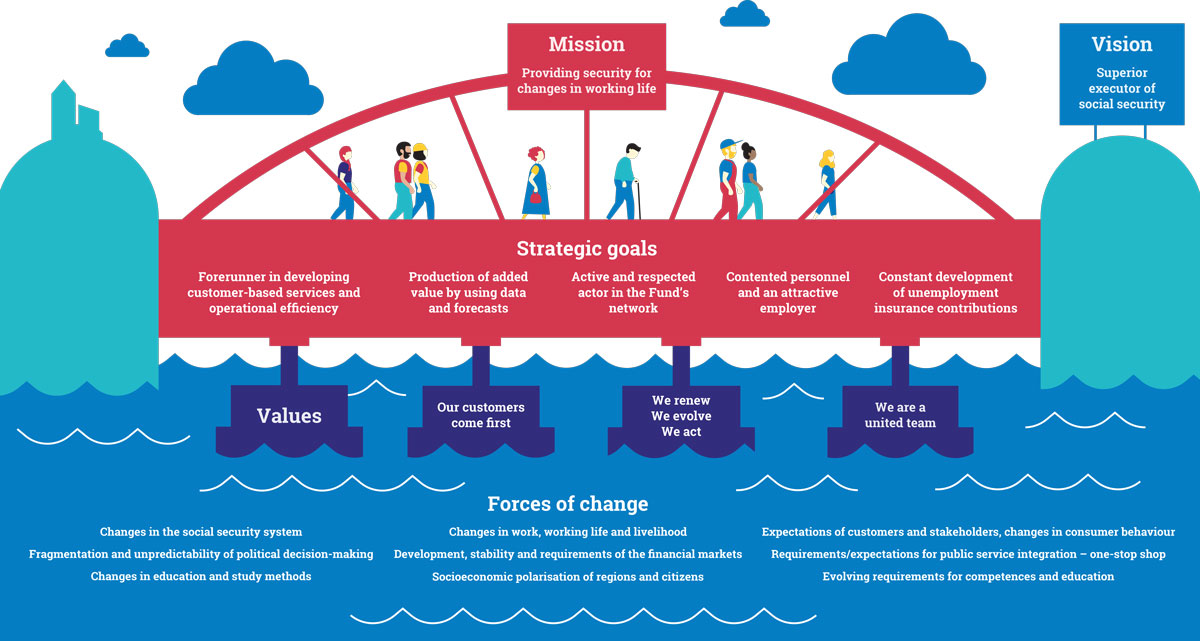

Providing security for changes in working life

Superior executor of social security

Our customers come first

We renew, we evolve, we act

We are a united team

Becoming a frontrunner in developing

customer-focused services

To develop the impact and efficiency of our

operations and to produce added value by

using data and forecasts

To be an active and respected actor in the

Fund’s network

To be an attractive workplace with healthy

employees

To keep the development of unemployment

insurance contributions steady

Regulatory compliance, ethicality and openness are important to us. To operate correctly and ethically, we need information about how we have performed in these areas. The Employment Fund has a whistleblowing system to ensure we collect this information effectively. You can use the system to report abuse in areas such as:

The whistleblowing system is an important tool for preserving high ethical standards and the trust of our investors, personnel, customers, partners and other stakeholders. The system allows you to report any suspected abuse with total anonymity. Please do not include any personal information unless it is vital to the report.